Pinduoduo’s Social Commerce Model

Pinduoduo (PDD Holdings), launched in 2015 and headquartered in Shanghai, has redefined ecommerce through its innovative social commerce model, blending group buying, gamification, and data-driven supply chains to capture China’s massive consumer base and expand globally via Temu. By Q2 2025, PDD boasts 800 million annual active users, a $541 billion Gross Merchandise Value (GMV), and $35 billion in revenue, making it the seventh-largest ecommerce player worldwide. Its growth—43% YoY—stems from a unique approach that turns shopping into a social, team-driven game, leveraging China’s mobile-first market (95% of purchases via app) and extending its playbook to 90+ countries through Temu.

Pinduoduo’s model isn’t just about selling cheap goods; it’s a cultural shift, engaging price-sensitive consumers (especially in China’s lower-tier cities) with discounts as high as 90% through collective purchasing. Facing regulatory pressures and global tariff challenges, PDD’s strategy evolves with AI, localization, and sustainability efforts. This post dissects its social commerce engine, with a visual for engagement and a stats table for clarity, drawing from sources like BCG, Forbes, and X sentiment as of September 2025.

Core Business Model: Team Buying Meets Consumer-to-Manufacturer (C2M)

Pinduoduo’s social commerce hinges on group buying, where users form “teams” via WeChat or the PDD app to unlock steep discounts by purchasing together. This C2M model connects consumers directly to factories, slashing costs by 30–50% compared to Alibaba or JD.com.

Key components:

Group Buying Mechanics: Users initiate or join teams (2–10 people) to buy items like $2 shirts or $10 appliances, sharing links on social platforms. Discounts scale with team size—e.g., 20% off for two, 50% for five. Over 60% of orders come from group deals, driving 70% repeat purchases.

C2M Supply Chain: PDD’s platform aggregates demand in real time, enabling 200,000+ merchants (many small factories) to produce small batches (100–500 units) with lead times of 5–10 days. This minimizes inventory waste (under 3%) and aligns with trends like $1 fruits or $5 electronics.

Revenue Streams: 65% from merchant fees/ads (3–8% commissions), 25% direct sales, 10% logistics/fintech (PDD Pay). Duo Duo Maicai, its grocery arm, contributes 15% of GMV via same-day delivery.

This model fueled PDD’s rise from zero to $100B GMV in five years, capturing 15% of China’s $1.47T ecommerce market by 2025.

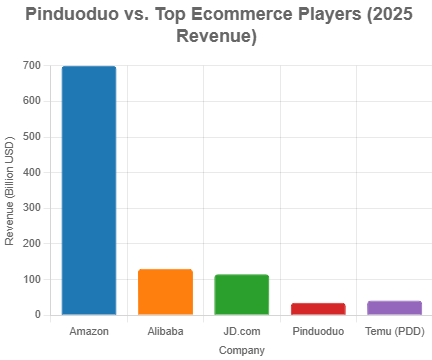

Visual Snapshot: Pinduoduo’s Revenue vs. Key Competitors (2025)

This bar chart compares PDD’s revenue to ecommerce giants, highlighting its rapid climb despite Amazon’s lead.

Stats Table: Pinduoduo’s Social Commerce Metrics (2025)

A snapshot of key drivers, user base, and growth metrics.

| Metric | Value (2025) | Source/Notes |

| Annual Active Users | 800M | Forbes, ECDB; 60% in Tier 3–4 cities |

| GMV | $541B | Markinblog; 43% YoY growth |

| Revenue | $35B | PDD Q2 2025; includes Temu’s $41B GMV contribution |

| App Downloads | 1.2B cumulative | Mobiloud; top shopping app in China |

| Categories | 10M+ SKUs (30% groceries, 25% fashion) | CedCommerce; daily drops: 5,000+ |

| Merchant Base | 200K+ | BCG; mostly small factories |

| Adoption Rate (Social Commerce) | 70% of orders via group buying | Business Model Analyst; WeChat-driven |

Sources: Forbes (Feb 2025), ECDB (2025), BCG (Jun 2025), Mobiloud, CedCommerce, Markinblog.

Marketing and Engagement: Gamification and Social Virality

Pinduoduo turns shopping into a social game, leveraging China’s WeChat ecosystem (1.3B users) and AI-driven engagement.

Gamified Experience: Users earn points via daily check-ins, spin wheels, or mini-games (e.g., “Duo Duo Orchard” for virtual fruit farming), boosting session times by 40% vs. Alibaba’s Taobao. Group buys offer up to 90% off, with 80% of users sharing deals socially.

Low-Cost Marketing: $500M ad spend (vs. Temu’s $2B) relies on organic WeChat virality. Micro-influencers (10K+ on Douyin) drive PDDHaul campaigns, amassing 500M views. X posts praise its “genius stickiness” for rural users.

AI Personalization: Algorithms tailor deals by location and behavior, increasing conversion rates by 25%. Flash sales (e.g., $0.50 produce) create urgency.

Result: 70% of China’s Tier 3–4 city residents use PDD, with 85% retention rate.

Product and Supply Chain Strategy

Pinduoduo’s catalog spans 10M+ SKUs, with groceries (30%), fashion (25%), and electronics (20%) leading.

Trend-Driven Drops: AI scans Douyin/WeChat for trends, launching 5,000+ daily SKUs with 80% sell-through. Duo Duo Maicai delivers fresh produce in 24 hours to 90% of China.

Affordable Quality: Prices 50% below JD.com; quality varies, but free returns (90-day policy) build trust. 2025 push: Premium lines for urban users.

Supply Chain Agility: Direct factory partnerships and blockchain tracking ensure transparency, cutting costs 20% vs. traditional retail.

Global Expansion via Temu

Temu, PDD’s international arm, applies the same model in 90+ markets, with $41B GMV in 2025. Key adaptations:

– Localized Sellers: U.S./EU programs onboard local merchants, with 25% inventory now non-China-based to dodge tariffs.

– Logistics Overhaul: Partnerships with ShipBob/FedEx cut delivery to 3–7 days; AR try-ons pilot in 2025.

Challenges and Sustainability Efforts

Pinduoduo’s meteoric rise faces hurdles:

Regulatory Scrutiny: China’s anti-monopoly probes fined PDD $500M in 2024; merchant complaints over 10% fines for delays persist. Temu’s EU data privacy issues and U.S. tariffs (60% on imports) add costs.

Sustainability Criticism: Overproduction fuels environmental backlash; PDD’s response includes 15% recycled packaging and carbon-neutral pilots. X users call it “fast fashion’s cousin.”

Profitability Lag: Q1 2025 net profit fell 47% due to Temu’s $1.9B losses, though narrowing from $8B.

Future Outlook: Scaling Social Commerce Globally

Pinduoduo aims for $60B revenue by 2026, with Temu targeting $100B GMV. AI-driven personalization, blockchain transparency, and grocery expansion (Duo Duo to 20% of revenue) are key. X sentiment hails its “addictive” model but warns of tariff risks.

Pinduoduo’s strategy—social hooks, C2M efficiency, and relentless discounts—redefines ecommerce for the masses. For merchants: Join early, but brace for fees; for shoppers: Bargains abound, but quality varies. Is PDD’s model a game-changer or a race to the bottom? Drop your thoughts below!

Sources: Compiled from Business Model Analyst, Forbes, BCG, ECDB, Mobiloud, CedCommerce, Markinblog, Cross-Border Magazine, AMZScout, Digital Marketing Institute, Retail Brew, Wikipedia, Medium (2025). X insights via September 2025 posts.