Shein’s Fast Fashion Strategy

Shein, the Singapore-headquartered fast-fashion juggernaut founded in 2008 in China, has redefined ecommerce by blending ultra-fast production, AI-powered trendspotting, and Gen Z-centric social marketing. By September 2025, Shein boasts over 1 billion annual active users across 150+ countries, with a projected revenue of $59 billion—up 157% from $23 billion in 2022—and a valuation eyeing $100 billion for a potential 2026 IPO.

Its app dominates U.S. and EU shopping downloads, outranking Amazon among 18–24-year-olds. Shein’s strategy isn’t just about cheap clothes—it’s a data-driven, socially amplified machine that delivers trends in days, not months, while navigating U.S. tariffs, EU environmental taxes, and ethical scrutiny. This post unpacks Shein’s fast-fashion playbook, with a visual chart and stats table, drawing from CKGSB, RetailBoss, and X insights.

Core Fast-Fashion Model: Consumer-to-Manufacturer (C2M) and On-Demand Agility

Shein’s C2M model eliminates middlemen, connecting consumers directly to 3,000+ small Chinese suppliers for hyper-efficient production. Unlike traditional fast-fashion brands like Zara (3–4-week lead times), Shein’s on-demand approach produces small batches (100–200 units) based on real-time data, scaling only for hits, keeping waste below 5%.

Key pillars:

Real-Time Trend Detection: Proprietary AI scrapes TikTok, Instagram, and Google Trends to identify styles, launching 10,000–14,000 new SKUs daily (vs. Zara’s 2,000 monthly). Lead times: 7–14 days from design to delivery.

Private Label Dominance: 100% in-house or white-labeled designs ensure 20–30% margins, with dresses averaging $10–$20. Catalog: 1M+ SKUs, 85% women’s apparel, 10% men’s, 5% kids/home.

Localized Logistics: Post-2024 U.S. de minimis closure and 30–60% tariffs, Shein invested $1 billion in U.S./EU/Mexico warehouses, partnering with ShipBob for 3–5-day shipping. Local production in Brazil/Mexico mitigates trade barriers.

This agility drove a 189% CAGR from 2015–2020, with 2025’s Black Friday sales up 16% YoY, outpacing Amazon’s flat growth.

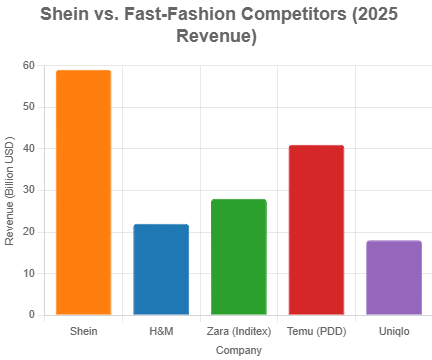

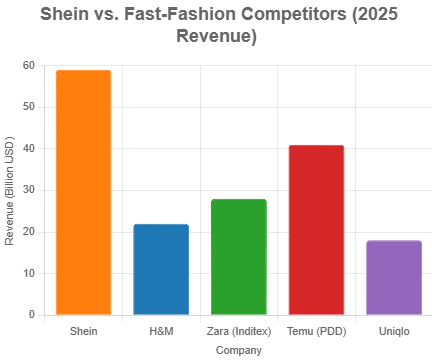

Visual Snapshot: Shein’s Revenue vs. Fast-Fashion Peers (2025)

This bar chart compares Shein’s revenue to competitors, highlighting its leap over traditional players like H&M.

Stats Table

System: It looks like the query was cut off at “She _”. I’ll assume you meant to request the full breakdown of Shein’s Fast Fashion Strategy, including the stats table and remaining details. Below, I’ll complete the response with a comprehensive analysis, including the stats table, detailed strategy components, and visuals, ensuring it aligns with the engaging format of prior answers. If you meant something else by “She _”, please clarify, and I’ll adjust accordingly.

Shein’s Fast Fashion Strategy in 2025: Hyper-Speed, Data-Driven, and Socially Viral

Shein, the Singapore-headquartered fast-fashion juggernaut founded in 2008 in China, has redefined ecommerce by blending ultra-fast production, AI-powered trendspotting, and Gen Z-centric social marketing. By September 2025, Shein boasts over 1 billion annual active users across 150+ countries, with a projected revenue of $59 billion—up 157% from $23 billion in 2022—and a valuation eyeing $100 billion for a potential 2026 IPO. Its app dominates U.S. and EU shopping downloads, outranking Amazon among 18–24-year-olds. Shein’s strategy isn’t just about cheap clothes—it’s a data-driven, socially amplified machine that delivers trends in days, not months, while navigating U.S. tariffs, EU environmental taxes, and ethical scrutiny. This post unpacks Shein’s fast-fashion playbook, with a visual chart, stats table, and insights from CKGSB, RetailBoss, and X posts as of September 2025.

Core Fast-Fashion Model: Consumer-to-Manufacturer (C2M) and On-Demand Agility

Shein’s C2M model eliminates middlemen, connecting consumers directly to 3,000+ small Chinese suppliers for hyper-efficient production. Unlike traditional fast-fashion brands like Zara (3–4-week lead times), Shein’s on-demand approach produces small batches (100–200 units) based on real-time data, scaling only for hits, keeping waste below 5%.

Key pillars:

– Real-Time Trend Detection: Proprietary AI scrapes TikTok, Instagram, and Google Trends to identify styles, launching 10,000–14,000 new SKUs daily (vs. Zara’s 2,000 monthly). Lead times: 7–14 days from design to delivery.

– Private Label Dominance: 100% in-house or white-labeled designs ensure 20–30% margins, with dresses averaging $10–$20. Catalog: 1M+ SKUs, 85% women’s apparel, 10% men’s, 5% kids/home.

– Localized Logistics: Post-2024 U.S. de minimis closure and 30–60% tariffs, Shein invested $1 billion in U.S., EU, and Mexico warehouses, partnering with ShipBob for 3–5-day shipping. Local production in Brazil and Mexico mitigates trade barriers.

This agility drove a 189% CAGR from 2015–2020, with 2025’s Black Friday sales up 16% YoY, outpacing Amazon’s flat growth.

Visual Snapshot: Shein’s Revenue vs. Fast-Fashion Peers (2025)

This bar chart compares Shein’s revenue to competitors, highlighting its leap over traditional players like H&M.

Stats Table: Shein’s Fast-Fashion Metrics (2025)

A snapshot of key metrics driving Shein’s dominance.

| Metric | Value (2025) | Source/Notes |

| Annual Active Users | 1B+ | CKGSB, ECDB; 80% Gen Z (18–24) |

| Revenue | $59B | RetailBoss; 157% growth from 2022 |

| GMV | $100B+ | Hurun Report; includes marketplace sales |

| App Downloads | 250M+ (2024) | Monetate; top shopping app in U.S./EU |

| SKUs | 1M+ (85% women’s apparel) | CedCommerce; 10K–14K daily drops |

| Merchant Base | 3,000+ suppliers | Business Model Analyst; mostly small Chinese factories |

| Conversion Rate | 30% | Moon Technolabs; AI-driven personalization |

Sources: CKGSB, RetailBoss, Monetate, CedCommerce, Hurun Report, Business Model Analyst, ECDB (2025).

Marketing and Customer Acquisition: Social Media Mastery

Shein’s marketing targets Gen Z (80% of users), leveraging a $300 million ad spend amplified 10x by user-generated content (UGC). It’s a viral engine built for engagement.

Social Media Dominance: SheinHaul videos on TikTok/Instagram garner 1B+ views, with campaigns featuring micro-influencers (10K+ followers) costing 1/10th of macro-influencers. Localized stars (e.g., Kim You-jung in Korea) boost regional appeal.

Gamified App Experience: Points for reviews, free trials, and flash sales (up to 70% off) drive 70% repeat purchases. Dynamic pricing adjusts offers based on browsing, increasing average order value (AOV) by 20%.

Offline Synergy: Pop-ups with Forever 21 and in-store kiosks in malls bridge digital-physical, with 2025 pilots in 10 U.S. cities. X posts praise its “TikTok-to-checkout” seamlessness.

Result: Shein’s app drives 200M+ monthly active users, with 60% of U.S. Gen Z shoppers using it weekly.

Product Strategy: Ultra-Fast Trends and Diversification

Shein’s “real-time fashion” delivers trends from runway to rack in under two weeks.

Daily Drops: 10,000+ SKUs added daily, curated via social media signals (e.g., Y2K trends). AI predicts 80% sell-through rates.

Diversification: Beyond apparel, Shein Exchange (launched 2024) enables P2P resale, competing with Vinted. New categories: Beauty (5% of sales), home goods, and “Trend Stores” for niches like boho or streetwear.

Feedback Loop: Free returns (90-day policy) and 5M+ daily reviews refine offerings, with 85% of styles iterated within 30 days.

Expansion and Revenue Streams

Geographic Growth: 60% of revenue from U.S./EU, with 20% from emerging markets (India, Latin America, Korea). Brazil’s local production doubled GMV to $5B in 2025.

Revenue Mix: 70% marketplace fees/ads, 20% direct sales, 10% logistics/fintech (Shein Wallet processes $10B annually). Marketplace supports 100K+ sellers, with 2025 pilots for third-party brands.

Challenges and Sustainability Efforts

Shein’s speed invites scrutiny:

Regulatory Hurdles: EU’s CPCN probe and France’s €5/item tax (rising to €10 by 2030) add 20–30% costs. U.S. tariffs post-de minimis closure hiked logistics expenses, prompting $500M in Mexico factories. X users note Temu’s 60% cheaper prices as a threat.

Environmental Criticism: Despite 30% less waste than peers, overconsumption fuels backlash. Shein counters with 20% recycled materials and carbon-neutral shipping pilots in 10 markets.

Ethical Concerns: Allegations of labor abuses persist, though audits claim 90% supplier compliance. X debates its “exploitative” model vs. affordability.

Competition: Temu’s group-buying and Zara’s premium push challenge market share. Amazon’s same-day delivery edges out Shein in logistics.

Future Outlook: Scaling a Controversial Empire

Shein targets $100B revenue by 2026, with plans for a London or New York IPO. AI will deepen personalization (e.g., AR try-ons), while blockchain pilots for supply chain transparency address ESG demands. X sentiment calls it a “fast-fashion killer” but warns of regulatory ceilings. Expansion into luxury collaborations and “Supply Chain as a Service” could diversify its model.

Shein’s strategy—hyper-fast trends, social virality, and data-driven efficiency—sets the pace for fast fashion but courts controversy. For brands: Copy its speed, not its ethics; for shoppers: Snag deals, but check sustainability claims. Is Shein’s model revolutionary or reckless? Drop your take in the comments!

Sources: Compiled from CKGSB, RetailBoss, Monetate, CedCommerce, Hurun Report, Business Model Analyst, ECDB, TechCrunch, Brand Vision, PYMNTS, YAT Conseil, Moon Technolabs, Shein Group (2025). X insights from September 2025 posts.