How Burgernomics (Big Mac Index) works

Table of Contents

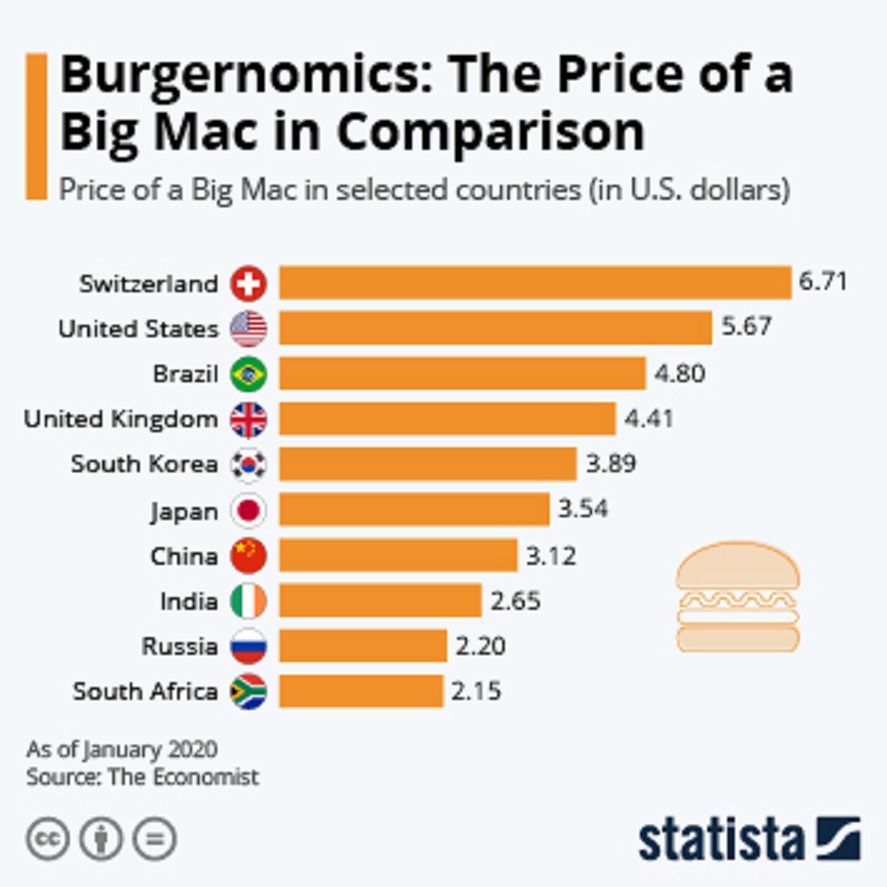

“Burgernomics” refers to the use of the Economist’s Big Mac Index as a measure of purchasing power parity (PPP) across different countries.

The term was first coined in 1986 when the Big Mac Index was published, and it uses the cost of a McDonald’s Big Mac as a price benchmark. The idea is to compare how various currencies relate to one another in terms of their buying power.

The Burgernomics is based on the theory of purchasing power parity (PPP), which states that in the long run, exchange rates should move towards the rate that would equalize the prices of an identical basket of goods and services (in this case, a Big Mac) in any two countries. The Big Mac was chosen for this index due to its global availability and the consistency of its ingredients, making it a suitable representative for a basket of goods.

The index can reveal whether a currency is overvalued or undervalued compared to the U.S. dollar. For instance, if the price of a Big Mac is higher in one country compared to the U.S., it could indicate that the currency of that country is overvalued. However, it’s important to note that the Big Mac Index was intended as a light-hearted guide and not a precise gauge of currency misalignment.

While the Big Mac Index is a useful tool for understanding exchange rate economics, it does have limitations. For example, it doesn’t account for differences in local economic factors such as labor costs, taxes, and market competition.

Additionally, the Big Mac is not sold in every country, limiting the geographic reach of the index. Despite these limitations, Burgernomics has been widely accepted as a method of analyzing exchange rates and has even been featured in many academic textbooks and reports.

How is Burgernomics calculated?

To calculate the Big Mac Index, the price of a Big Mac in a foreign country (in the foreign country’s currency) is divided by the price of a Big Mac in a base country (in the base country’s currency), typically the United States.

This comparison provides an implied exchange rate between the two currencies. If the calculated exchange rate is higher than the actual exchange rate, the first currency is considered overvalued; if it is lower, the first currency is considered undervalued compared to the second.

The limitations of the Big Mac index

The Big Mac Index has several limitations, including:

1. Geographical coverage: The index is limited by the presence of McDonald’s franchises. McDonald’s is not present in every country, which means the index has limited geographical reach, particularly in Africa.

2. Single item: The index is based on a single item, the Big Mac, which lacks the diversity of other economic indicators.

3. Non-traded services: The price of a Big Mac is influenced by factors like labor costs, but this is not a direct reflection of relative currency values. The index does not account for non-traded services, which can have different prices across countries.

4. Inflation measurement: While the Big Mac Index can be used to measure inflation over time, it is not as comprehensive as other indices like the Consumer Price Index (CPI).

5. Market fluctuations: The index provides a long-term view of a possible market correction but does not address current or short-term fluctuations that are of interest to many forex traders. It should be used as one analysis tool, not the sole basis for trading decisions.

Despite these limitations, the Big Mac Index remains a useful tool for illustrating the concept of purchasing power parity and for comparing currency values in a lighthearted manner.

How the Big Mac index compares to other exchange rate indices

The Big Mac Index, introduced by The Economist, is a lighthearted yet widely recognized tool for comparing purchasing power parity (PPP) between countries.

In contrast to other exchange rate indices, the Big Mac Index (Burgernomics) stands out due to its simplicity and relatability. It uses the price of a Big Mac in different countries to calculate an implied exchange rate, providing a straightforward way to compare currency values.

This approach makes it more accessible and understandable to the general public compared to other indices like the Consumer Price Index (CPI) or other complex economic indicators.

While the Big Mac Index has its limitations, such as its reliance on a single product and the geographical coverage due to the presence of McDonald’s franchises, its unique approach and widespread recognition have made it a valuable tool for illustrating the concept of PPP and for comparing currency values in a relatable manner.

What is the Big Mac Index Formula?

The Big Mac Index is calculated by dividing the price of a Big Mac in a foreign country (in the foreign country’s currency) by the price of a Big Mac in a base country (in the base country’s currency), typically the United States.

This comparison provides an implied exchange rate between the two currencies. The formula to calculate the index is:

$$Exchange\ rate, E’ = \frac{Big\ Mac\ in\ currency\ A}{Big\ Mac\ in\ currency\ B}$$

Comparing the calculated exchange rate, E’, with the official exchange rate, E, between currencies A and B:

– If E’ < E, currency A is undervalued.

– If E’ > E, currency B is overvalued.

Some alternative indices to the Big Mac index

Some alternative indices to the Big Mac Index include:

1. Starbucks Tall Latte Index: Similar to the Big Mac Index, this index compares the cost of a Starbucks tall latte in different countries, providing a sense of the cost of living and purchasing power in each country.

2. KFC Index: In some regions, the KFC Index is used similarly to the Big Mac Index, as KFC outlets are more common in certain countries.

These alternative indices, like the Big Mac Index, use the prices of common items around the world to compare purchasing power and the cost of living.

How does the Big Mac index account for inflation

The Big Mac Index accounts for inflation by allowing investors to measure inflation over time and compare it to official records. This can help in valuing bonds and other securities sensitive to inflation.

The index also shows inflation in burger prices over time, allowing for comparisons of the price of a Big Mac across countries in the same currency, revealing where burgers are cheaper or relatively more expensive.

For example, a Forbes article compares the Big Mac Index (BMI) to the official Consumer Price Index (CPI) and shows that while annual BMI inflation through December 2021 and since 1996 has been 3.54%, the CPI has only reported 2.31% inflation. This suggests that the amount of inflation reported by the CPI may be underreported.

In summary, the Burgernomics provides a unique perspective on inflation by tracking the price of a specific item, the Big Mac, across different countries and comparing it to official inflation measures such as the CPI.

Continue reading: How To Make Money From Retail Arbitrage