Global financial markets are experiencing a significant downturn

Table of Contents

Global financial markets are experiencing a significant downturn

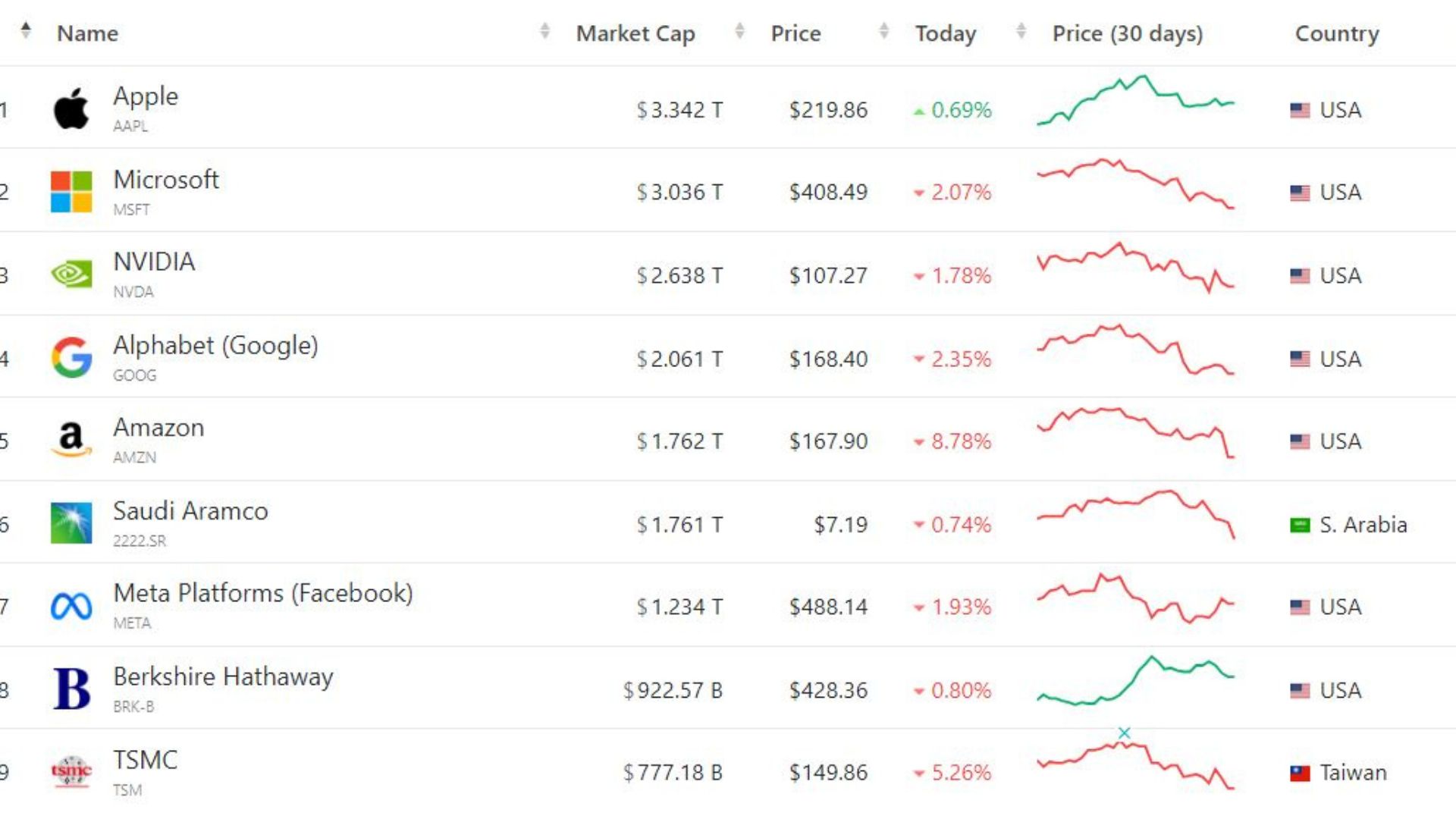

Global financial markets are experiencing a significant downturn as investors increasingly seek refuge in safe-haven assets amid rising recession fears.

The sell-off has been exacerbated by disappointing economic indicators and shifting monetary policies from central banks, notably the Federal Reserve and the Bank of Japan.

Key Developments

The catalyst for the recent market turmoil was the release of a lackluster U.S. jobs report, which raised concerns about the strength of the economy. Many investors are questioning whether the Federal Reserve made a mistake by keeping interest rates stable during its last meeting.

The report has intensified fears that the U.S. economy may be heading toward a recession, prompting a wave of selling across global stock markets.

Global Financial Market Reactions

In Asia, the situation has been particularly dire, with Japanese stocks confirming a bear market. The Nikkei 225 index suffered a staggering 12.4% decline, closing at 31,458.42—its worst day since the infamous “Black Monday” in 1987. This drop of 4,451.28 points marks the largest point loss in the index’s history, highlighting the severity of the current market conditions.

In Europe, the Stoxx 600 index fell by 2.34%, with all sectors and major regional markets trading in negative territory. Technology stocks were hit hard, initially dropping by as much as 5% before recovering slightly to a decline of 2.8%. Meanwhile, mining shares decreased by 3.65%, and banking stocks were down by 3.22%.

Safe-Haven Assets

As stock prices plummet, investors are flocking to safe-haven assets. The Swiss franc appreciated by 1.2% against the U.S. dollar, reaching 0.847, its strongest position since January.

U.S. Treasury yields also fell, with the yield on the 10-year Treasury hitting a one-year low of 0.709%. The two-year Treasury yield was last seen at 3.7315%, down approximately 14 basis points.

Gold futures rose by 0.38%, trading at $2,479.20 per ounce, as investors turned to the precious metal for stability in the face of market volatility.

Expert Insights

Ted Alexander, the chief investment officer at BML Funds, commented on the ongoing market volatility, suggesting that while the current situation may seem alarming, it has been anticipated for some time.

He noted, “Everyone’s been expecting it for a while; it’s great for active managers.” Alexander emphasized that this upheaval might encourage equity investors to return if stock prices become more attractive from a value perspective.

He advised against completely withdrawing from technology and growth sectors, stating, “Stock markets aren’t finished yet.”

Conclusion

The global stock rout reflects deepening concerns about economic stability and the effectiveness of current monetary policies. As investors navigate this turbulent landscape, the shift toward safe-haven assets suggests a cautious approach in the face of uncertainty.

The coming days will be critical in determining whether markets can stabilize or if further declines are on the horizon. Investors and analysts alike will be closely monitoring economic indicators and central bank responses as they assess the potential for recovery.

Continue reading: South Korea offers relief aid amidst North Korea flooding crisis